2012 Hotel Industry Outlook: A Distribution Shuffle

Yes 2012 will be all about distribution in the hotel industry. There are some major developments that demand attention of hoteliers in order to stay in control of the market mix and distribution cost. Here some of the hot topics of next year: Google Hotel Finder, Meta-Search and Rate Parity, OTA Commission Levels, Direct Sales …

Yes 2012 will be all about distribution in the hotel industry. There are some major developments that demand attention of hoteliers in order to stay in control of the market mix and distribution cost. Here some of the hot topics of next year: Google Hotel Finder, Meta-Search and Rate Parity, OTA Commission Levels, Direct Sales …

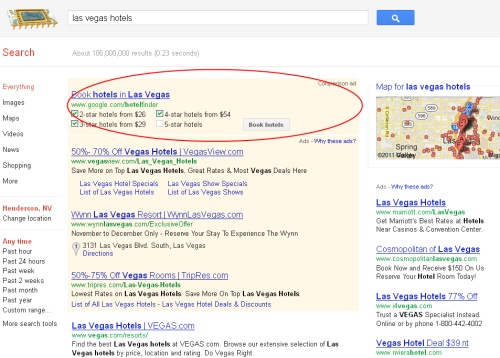

Many things are going on at the moment and it’s hard to figure out where to start. A major development that will most certainly impact the balance of the distribution world is the launch of Google Hotel Finder. Google has developed its own meta-search (price comparison) tool as a counter move to Bing’s acquisition of Farecast now called Bing Travel. It’s funny no … ? How everyone is throwing a fit over Google entering into the travel meta-search market, but we seem to have forgotten about Bing Travel.

Google Hotel Finder

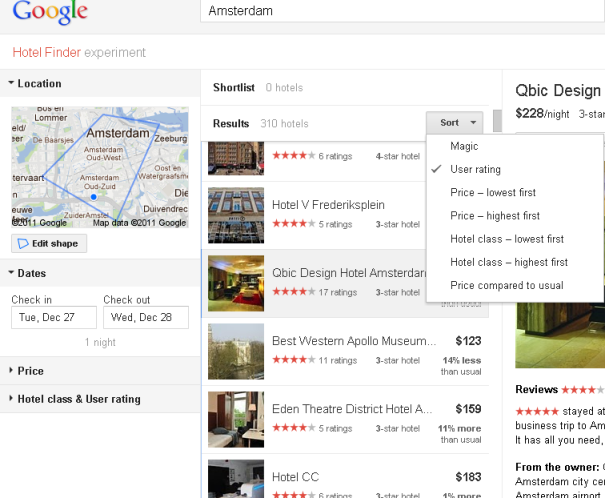

In any case recently Google has started testing with displaying Google Hotel Finder ads above the regular Google Ads. Of course this is causing mayhem and concern in the industry. They are effectively out-maneuvering meta-search sites like HotelsCombined, Kayak and Trivago with one simple step. Google Hotel Finder of course compares rates from major OTA which are paying heavily to show up there. So no, the OTA won’t lose out in volume, one could rather conclude that in the initial stages it will be a consolidation of volume to the larger OTA, until Google has integrated also more regional and local channels.

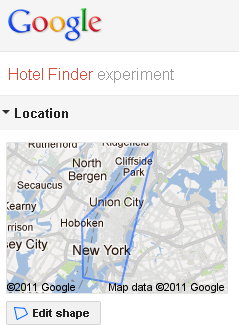

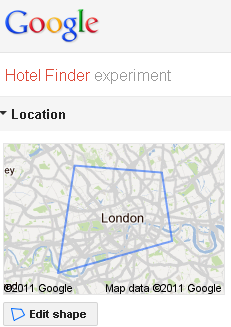

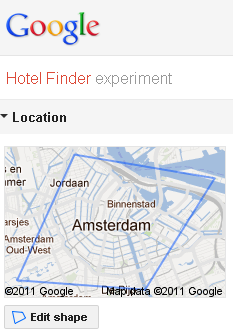

What impact does this have on hotels? There are different angles here. First of all, Location has just become even more important. Is your hotel situated within the preset parameters of your market according to Google Hotel Finder. For New York, London and Paris the settings seemed quite all-encompassing, but for Amsterdam Google Hotel Finder somehow is zoomed in to the city center, ruling out hotels in the surrounding areas in the pre-set search.

A quick tip for hotel investors, make sure your new hotels are within the zone …

So what else should hotels consider when it comes to Google Hotel Finder? The big thing brought to us by TripAdvisor : Reviews. Google over the last few years has started collecting initially reviews from other websites to determine popularity and value of your hotel property. Moreover it has been collecting guest reviews also through Google Places (formerly known as Google Local Business Center). A mix of all the reviews determines your user rating by which consumers can also sort the hotels.

As to be suspected the reviews which are shown on the hotel page are only the ones from Google Places. For the other sites there is a smaller reference at the bottom of your hotel listing with the number of reviews. Google does not even show a score for these other websites, which is something we admire from Trivago’s hotel listings.

Yes ladies and gentlemen hoteliers Google is on a mission to build the undisputed platform for travel search. It will use other sides for as long as it needs to get its own initiatives sufficiently of the ground and will then move them into the background.

So in your efforts to gain traveler reviews and good guest scores we have to look beyond TripAdvisor, Oyster, Zoover, Vinivi, HolidayWatchDog, VirtualTourist, Yelp, etc. Google Places and Google Hotel Finder have overnight gained huge significance when it comes to hotel reviews.

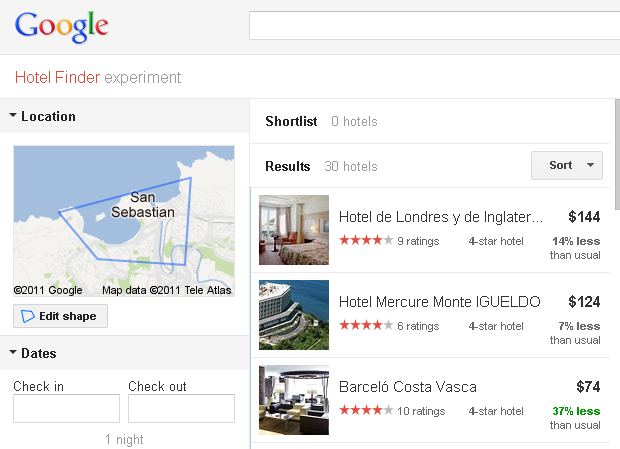

Just imagine the impact on your demand and sales when Google launches Hotel Finder into pole position for all hotel searches worldwide if you are listed as #1 on the preset sort order like Hotel de Londres in San Sebastian.

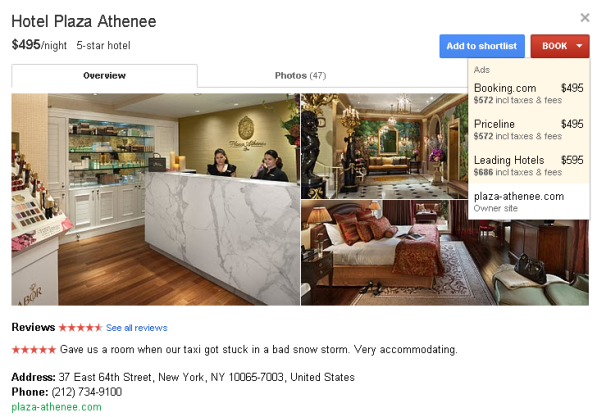

Google will show not only OTA, but also GDS Rep companies are listed, giving you a chance to get the reservation through lest costly and preferred channels. You will have to press your GDS representation company to develop an interface with Google Hotel Finder. Moreover it lists your hotel website URL. See the example below of the Plaza Athenee Hotel in New York.

Of course listing your website URL and phone number is free right now through Google Places, but we would not be surprised of Google would start charging hotel for this in the near future. In any case it is very important to have your account set-up well in Google Places as it will help your hotel as well to show in Google Universal Search results. Google Maps.

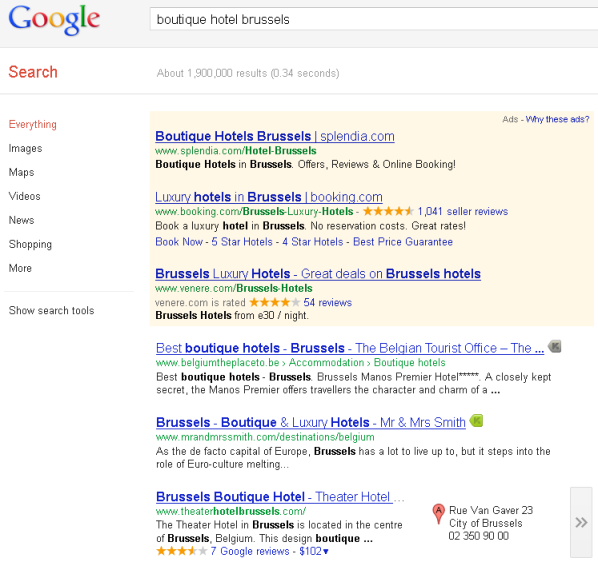

Below a screen shot for the search ‘Boutique Hotel Brussels’ where you see the Theather Hotel , a small independent property, popping up:

Meta-Search & Rate Parity

Many hotels are trying to maintain a rate parity strategy on OTA to level the playing field and create transparency for consumers. However these efforts are being completely torpedoed by wholesalers publishing net rates at low mark-ups online. We see wholesalers distributing package rates and net rates at low mark-ups directly and through affiliates that are listed on meta-search sites like Kayak, Trivago and HotelsCombined. Here a random date for the London market on Trivago:

Hotels need to make sure they have their distribution well under control across all channels, online and offline. Wholesalers are great channels, but hotels have to impose rules on the low net rates they offer and enforce them strictly, otherwise a strategy of rate parity might just be counter effective. Don’t alow your offline rates to get online!

Increasing Commissions & Cost of Distribution

We have seen some OTA flexing their muscles this year as well, asking for quite high fixed allotments, yet another sign they are trying to penetrate hotels and the market as far as possible. This happens when they can’t really grow anymore geographically but are pressed by their shareholders for growth each year. Unless we will start opening hotels on the Moon in the next few years, the only way some agencies can grow is by getting a higher commission % or control more inventory in your hotel.

So our advice is to be careful and develop alternative sales channels.

Direct Sales Becoming Increasingly Important

We are seeing hotels becoming more aware each day of depending too much on online travel agencies, wholesalers and other 3rd party distributors. The rising cost of distribution and the advantages of direct sales is something hoteliers are starting to understand more profoundly. Therefore we foresee a shift or rather a re-shuffle in the distribution mix in hotels in 2012.

Hotels are willing to invest more in SEO, SEM, SMM and Mobile marketing as a results of the increasing cost of distribution. They are now more than ever pushing to increase their direct sales, through their own website as well as their call center.

You should perhaps read our last article on a 2012 Marketing Plan for Hotels to get some more ideas on how you could tackle these challenges.

GDS Comeback

The Hotel GDS is of course no longer what it used to be. But it is making a small comeback. Over the last years we have been able to grow production through this channel. It has brought us subsequently more direct corporate negotiated accounts.

We hope to have shed some light on what it to come in 2012 for your hotel in terms of marketing, distribution and revenue management.

Share This Story, Choose Your Platform!

About the Author:

As CEO and Founder of XOTELS, Patrick Landman has made it his mission to turn hotels and resorts into local market leaders. XOTELS´ diverse expertise and deep-knowledge across revenue management consulting, hotel management, and hotel consulting, enables us to drive results for independent boutique hotels, luxury resorts, and innovative lodging concepts. Below you will find opinion articles written by Patrick Landman.