5 Tips to Maximise Your Hotel Metasearch Advertising Revenue

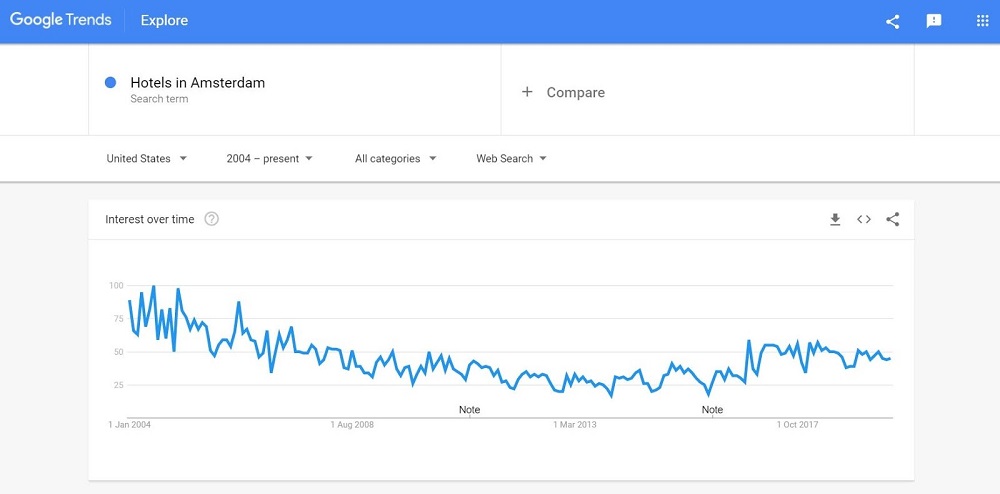

Amsterdam has a problem with over-tourism: we all know that. With 3 Billion € revenue per year generated by travelers, you’d expect search volume for queries such as “Hotels in Amsterdam” to have skyrocketed over the years, wouldn’t you? Well, get ready to be disappointed. What if I told you that traffic for such query has, instead, been plummeting, and its volume is now half of what it used to be back in 2014?

So how do you adjust you hotel marketing strategy?

You can see by yourself, by looking at the GoogleTrends graph below.

This (seeming) paradox can be explained by a quite recent shift in travelers’ behavior. If classic, horizontal search engines used to be at the top funnel of the booking journey for a good part of the ’00s, in fact, their function has been more and more delegated towards mid and bottom-funnel, while vertical, metasearch engines overtook their place.

So how does this impact your hotel revenue management and marketing strategy?

After the Physics

Let’s get this straight: booking a hotel today is a pain in the butt. It used to be even worse. If you’re old enough to remember how frustrating it was to plan your romantic weekend on Altavista, you know what I’m talking about. Luckily enough, somewhere around 2005, metasearch came to rescue and made the whole booking journey more straightforward. Instead of having to navigate in an ocean of hyperlinks, thanks to metasearch engines, the best accommodation started being just a couple of clicks away. In essence, de facto, a metasearch engine is nothing but an aggregator of links. The word meta comes from the Greek μετά and, with respect to the proposition, can mean “after,” “with,” “beside,” “beyond,” “adjacent,” “self” or “among.” Not confused yet? Hold on. On the 4th century, Aristotle wrote the Physics: it was a bestseller. So, he decided to write a sequel, titled -wait for it- Metaphysics (ergo: the book “after” Physics). In modern English, meta is “a prefix added to the name of a subject and designating another subject that analyzes the original one but at a more abstract, higher-level”. I like this definition: metasearch engines, according to it, are simply the “higher level” of old-school search engines. Moreover, over 90% of travelers using metas to organize their travels, the level is pretty high.

Follow the Money

The interest towards metasearch engines in travel is evident, especially when it comes to OTA investments and acquisitions in meta brands: Booking Holdings owns, amongst others, Kayak, Momondo Cheapflights, HotelsCombined, SWOODOO, Checkfelix, and Mundi, and Expedia still maintains the majority of Trivago’ stock. These acquisitions led to a progressive hybridization between metasearch engines and OTAs, with paradoxical situations where Booking.com advertises on TripAdvisor, which, then, advertise on Google Hotel Ads, and so on ad infinitum.

Where Metas go to Die

Semantic nuances aside, metasearch engines do little more than, to quote an insightful whitepaper by EyeForTravel, “simply redirect the travel buyer to vendors’ booking engine”. With one, important, exception, that we’ll cover in the next paragraph. An anonymous source admitted that TripAdvisor is losing “a ton of traffic” to Google, and the Instant Booking disaster is no big news. Meanwhile, Trivago struggles to remain profitable: up until 2017, in fact, the German metasearch was backed up by Booking Holdings and Expedia Group’ significant investments (rumors say around 10% of their global advertising budget). Things started going south when Booking drastically reduced its investments (many speculations were made about the real reason behind it but, in retrospect, the main trigger was very likely the introduction in the company’s algorithm of the infamous “relevance assessment score”, which penalized all the advertisers -such as Booking.com- using generic multiple-property-search-result landing pages, rather than property-specific ones). As Bank of America prosaically put it, commenting Q2: “Trivago, has to choose: margin or growth — but not both.” Margin is back but, without growth, this seems the path to irrelevance.

Google Takes it All

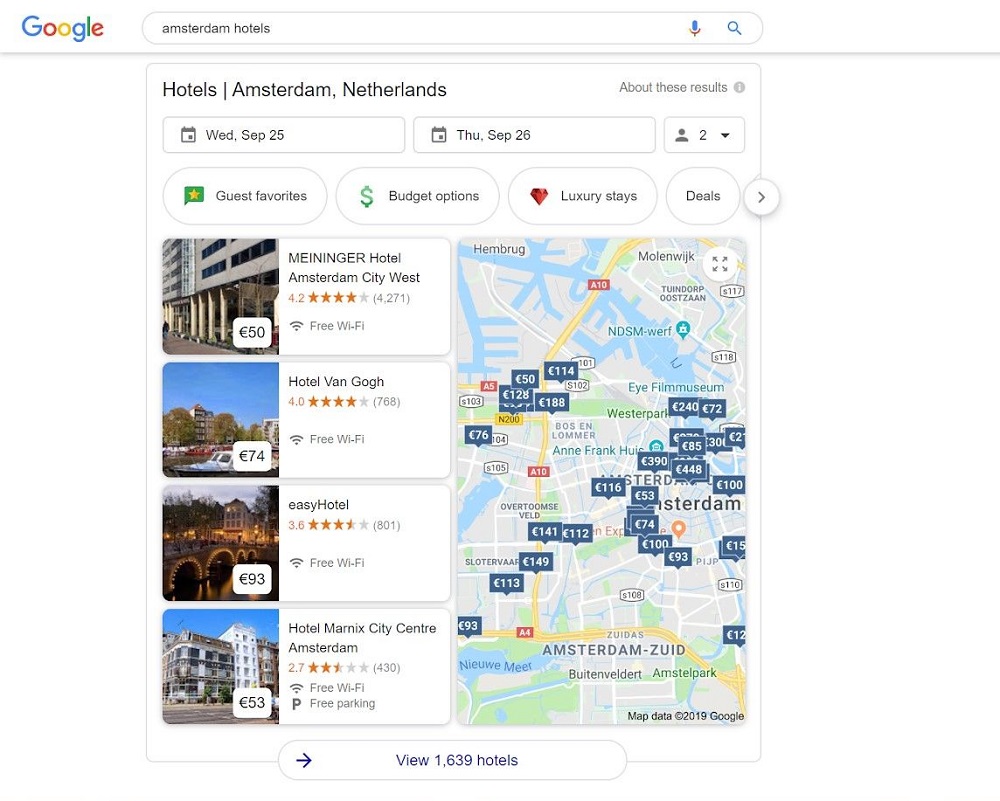

During a recent hearing in front of the U.S. Congress, where Big G. has been labeled as a “near monopoly”, Google’s Director of Economic Policy, Adam Cohen, downplayed it by stating that the market is “much broader”, and that when travelers are searching for “places to travel, hotels and airlines, they start with dedicated specialist competitors”. Data tell a very different story. According to Mirai, Google Hotel Ads reached “67% of all investment in metas in 2019”. AdsHotel provides similar figures, with Big G. taking half of the cake.

Moreover, recently, Google announced that all partners would have to migrate their Hotel Ads campaigns from the Hotel Ads Center to Google Ads. As Koddi puts it, this will bring “more flexibility in bidding and campaign optimization,” as it allows advertisers to finely target their reference market(s). This means that Google will be the exception I spoke about in the previous paragraph: a metasearch engine that will be able to do more than “simply redirect the travel buyer to vendors’ booking engine.”

Divide and Conquer: What Now?

At a closer look, however, the evolution of metas over the years seems not quite different from the evolution of OTAs and bed banks. If you’ve been in the industry long enough, you may remember how local, relatively small players used to be very relevant, both in terms of branding than revenue generated. Roman website Venere.com, founded in 1994, is a great example. Also, what about Gullivers Travel Associates, Octopus Travel, or DER? Or niche, luxury players such as Splendia? All acquired or merged. In the same fashion, Google is likely to expand its travel realm, either by acquisitions or by bringing competitors on the edge of irrelevance. The trend is unlikely to revert, so it’s time hoteliers wake up from their TripAdvisor-centric approach and start investing where the volume (and ROI) is.

Uncover the hidden revenue potential of your hotel

or resort.

Our Top-5 Suggestions Are:

- Find a trusted Google partner that can assist you in advertising on Google Hotel Ads (GHA, for short) and BookOnGoogle (BoG, for short). A full list can be found here.

- Google Hotel Ads campaigns are very sophisticated, with hundreds of variables and, very likely, this complexity and sophistication will increase with the upcoming Hotel Ads/Ads merge. Manage meta campaigns with specialists, which can closely work with your revenue management department: rate leakage, in fact, is one of the main reasons why many meta campaigns underperform. Moreover, bidding should be very dynamic, based on your future rates, availability, and feeder market depending on seasonality.

- Your advertising budget should be moving organically from Tripadvisor, Trivago, Kayak, and even Google Ads towards GHA and BoG.

- Make sure your Google MyBusiness listing is always up-to-date, as this is the primary entry point for most Google users.

- Answer to ALL users questions on Google MyBusiness and reply to the Google reviews. If you have time only for one platform, then drop TripAdvisor and focus on Big G.

Also, most importantly, metasearch advertising is an ever-moving target, so never, EVER, stop testing and learning.

And eventually we will see AI (Artificial Intelligence) making inroads in this hotel marketing area, replacing part of the manual analysis and bidding with smart technology.

Meta-search is becoming a key part of your hotel revenue management strategies, to control the cost of distribution!

More Free Resources

Top 10 Popular Posts

Blog Categories

Share This Story, Choose Your Platform!

About the Author:

As CEO and Founder of XOTELS, Patrick Landman has made it his mission to turn hotels and resorts into local market leaders. XOTELS´ diverse expertise and deep-knowledge across revenue management consulting, hotel management, and hotel consulting, enables us to drive results for independent boutique hotels, luxury resorts, and innovative lodging concepts. Below you will find opinion articles written by Patrick Landman.