Popular Hotel Valuation Models and Appraisals for Owners

Do you like making decisions with sound info? Of course! So do hotel buyers, lenders, owners and sellers. Making informed decisions about potential or operational hotel investments means using accurate hotel valuation methods. Numerous methods exist, each with good and bad points.

It’s the classic hotel real estate issue… how do you determine a hotel’s value without selling it?

Here’s the guide to hotel valuation methods we put together from our point of view as a hotel revenue management consulting company.

1. Why are Hotel Valuation Methods Needed?

There are many stakeholders and scenarios that require a hotel’s market value estimate:

- So investors or lenders can analyse and continue investment and lending decisions

- So owners can decide whether to hold or sell, versus various capital return scenarios

- So owners can forecast holding period returns and measure annual value changes

- So owners can define dogs and stars in real estate portfolios and investment funds

2. The Hotel Valuation Methods

There are essentially 3 popular hotel valuation methods. Different consultants, real estate appraisers and mainstream hotel valuation firms may use different and multiple methods. Either way, hire a professional appraiser. It will prove more expensive to hire an amateur!

SELL MORE HOTEL ROOMS

SELL MORE HOTEL ROOMS

via the WIWT Affiliate Network.

via the WIWT Affiliate Network.

These hotel valuation methods are:

- the market comparison approach

- the cost approach

- the income approach

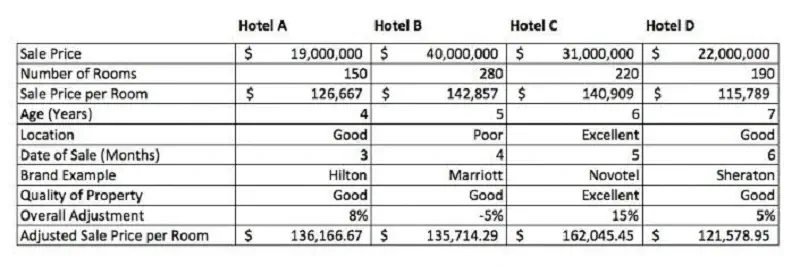

a. The Market Comparison Approach

It’s simple – this hotel valuation method says a hotel is worth the same amount of money that a similar property within a similar market recently sold for. Recent sales data is collected and adjusted for differences amongst the hotels, to find the estimated value.

Here’s how a market comparison valuation can be conducted:

- research the market to find recently sold, similar properties

- reject any irrelevant properties (i.e. non market value sites)

- compare physical characteristics, time of sale and condition

- adjust for differences based on priorities in that hotel market

- from the data, estimate a final value for the hotel transaction

Without data, this hotel valuation method doesn’t work. Another weakness? No two sites are truly comparable. Market comparisons are tough for unique and high-quality hotels!

b. The Cost Approach

This hotel valuation method assumes a property is worth what it costs to rebuild, less any accumulated depreciation. A developer’s profit may be included but the hotel value cost approach puts a ceiling on value. Follow these steps to estimate value:

- estimate the cost to replace or replicate the structure (not including land value)

- account for the loss in property value (depreciation) by straight-line or breakdown

- deduct the total depreciation from the estimated new replace or rebuild costs

- and the land value to the depreciated value of the hotel plus any improvements

It’s still a limited hotel valuation method. All estimates can be inaccurate and subjective.

c. The Income Approach

These hotel valuation methods consider the present value of future hotel cash flows. It accounts for future benefits including the net incomes and forecasted proceeds of future sales. Techniques include the capitalisation rate process and discounted cash flow analysis. These valuations focus on stabilised annual hotel earnings and exclude potentially beneficial or bad scenarios. It’s the most persuasive hotel valuation method.

As always, our hotel revenue management consulting experts are ready to assist you with any of your concerns. Don’t hesitate to contact us.

Cheers,

Patrick Landman

Looking to invest yourself? Find your next property investment opportunity here.

Uncover the hidden revenue potential of your hotel

or resort.

More Free Resources

Popular Posts

Blog Categories

Share This Story, Choose Your Platform!

About the Author:

As CEO and Founder of XOTELS, Patrick Landman has made it his mission to turn hotels and resorts into local market leaders. XOTELS´ diverse expertise and deep-knowledge across revenue management consulting, hotel management, and hotel consulting, enables us to drive results for independent boutique hotels, luxury resorts, and innovative lodging concepts. Below you will find opinion articles written by Patrick Landman.